Wise Equity has entered the capital of Absolute Yachts. Just a few minutes ago, news broke of the signing of a binding agreement that involves the acquisition of a majority stake by the Wisequity VI fund. This important operation is also accompanied by several co-investors and the majority of the current shareholders that significantly supported the capital increase. Angelo Gobbi has been awarded the honorary presidency, an undeniable sign of Wise Equity’s intention to ensure strategic continuity for the company.

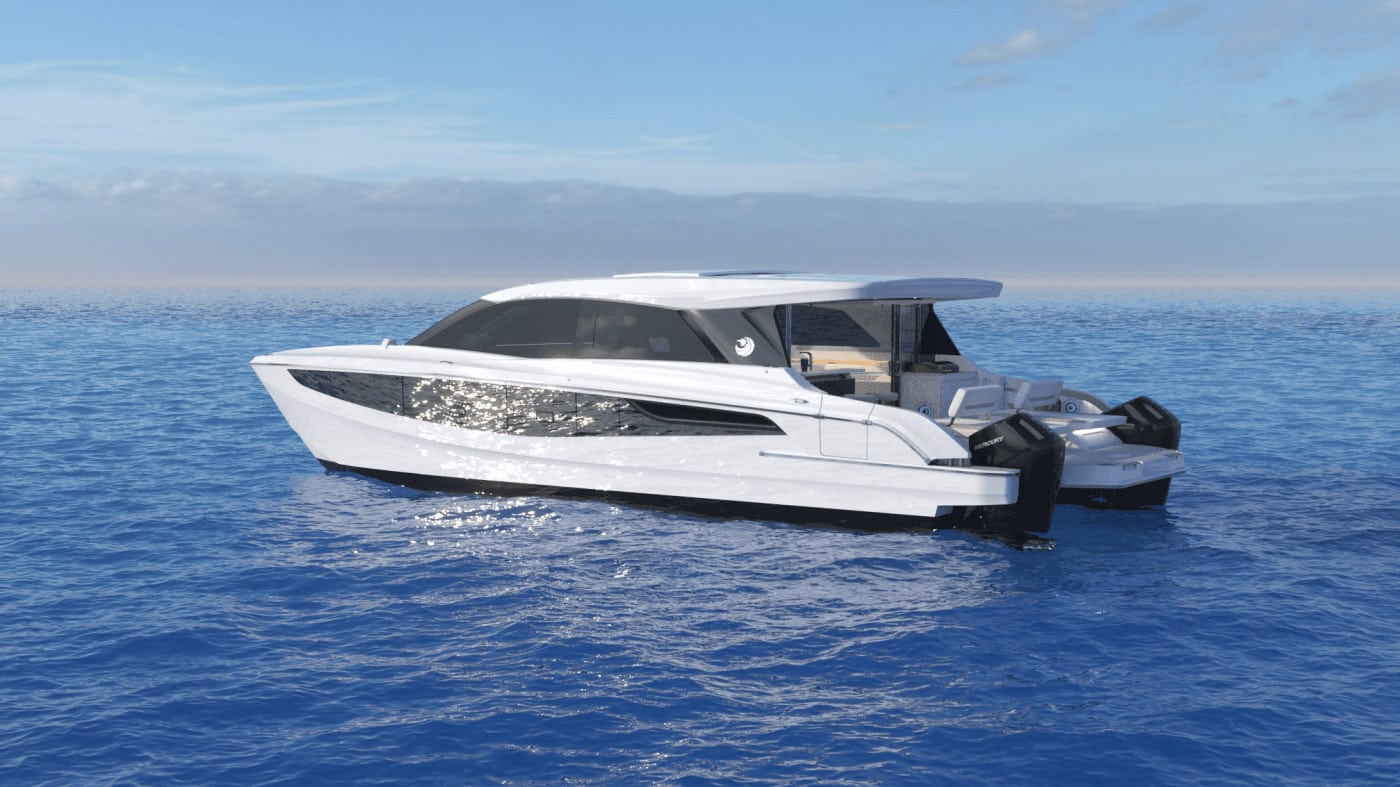

The renowned company is headquartered in Piacenza and is the undisputed international leader in the trawler segment, a type of vessel increasingly appreciated by yacht owners worldwide. Absolute Yachts expects to close its fiscal year at the end of August with a total revenue of over 110 million euros, 90% of which is generated abroad, in more than 30 countries.

Absolute Yachts is a success story, founded in 2002 by Sergio Maggi and Marcello Bè. The company has grown at a remarkable pace over the years, garnering a long list of awards for both economic performance and design.

We must continue to evolve, as we always have, and we want Absolute Yachts to remain at the forefront of stylistic and technological innovations, capable of anticipating the new needs of yacht owners and the market – says Angelo Gobbi, President of Absolute – We immediately recognized Wise Equity as the ideal partner to strengthen and support our development path, infusing new energy, further ideas, and strategic support.

The knowledge of the sector and the affinity of values between the people of Wise Equity and Absolute represent for us a guarantee of respect for the history, partners, territory, and customers of Absolute”.

Wise Equity SGR is a company active in managing closed-end investment funds that invest in small and medium-sized companies with a special focus on Italy. The funds managed by Wise Equity typically engage in Leveraged Buy-Out operations and development capital for companies that hold leadership positions in their niche, with two main objectives: increasing critical mass, including through “build-up” operations, to improve the competitiveness and profitability of companies and to support their international development.

Wise Equity currently manages three funds:

Wisequity IV with a capital of 215 million euros, fully invested in eight companies, three of which are still in the portfolio;

Wisequity V launched in July 2019 with a capital of 260 million euros, invested in eight companies, seven of which are still in the portfolio following the sale of Cantiere del Pardo;

Wisequity VI launched in May 2023 with a capital of 400 million euros, of which Absolute represents the fourth investment.

“For Wise Equity, the trust placed in us by the partners of Absolute is an honour and a great responsibility – states Fabrizio Medea, Senior Partner of Wise Equity – Absolute is a shipyard with a strong market position. The company has reinvented the ‘navetta’ style boats, designed to maximize comfort and livability without sacrificing innovation and design, achieving undisputed leadership in this segment. Absolute has also profoundly reinterpreted the Fly yacht category with innovative and differentiating features compared to what can be currently found on the market. The investment in Absolute perfectly reflects the fund’s strategy, which invests in Italian excellence to accompany them on their clear path of growth. We are confident that we can also rely on a strong synergy with the territory and all the people of Absolute, whose passion and dedication are a defining element of the company’s success. Our priority will therefore be to preserve everything that has been built and to support the company’s leadership in an even more exciting future”.

Wise Equity was assisted in the transaction by:

Simmons & Simmons for legal due diligence and contract work, with Andrea Accornero, Moira Gamba, Paolo Guarneri, Ida Montanaro, Carla Nuzzolo;

KPMG for financial due diligence, with Matteo Ennio and Carmine Scannelli;

Studio Spada Partners for tax due diligence and deal structuring, with Guido Sazbon, Francesco Podagrosi, and Gaetano Piazzolla;

– ERM for ESG/EHS due diligence, with Giovanni Aquaro, Federica Rinaldi, Maddalena Bonizzoni, Gioele Meroni, and Tommaso Turbati;

Kilpatrick Executive for organizational pre-assessment, with Jacob Hoekstra;

Pirola Corporate Finance S.p.A. for debt structuring, with Mario Morazzoni and Edoardo Agnello;

Banco BPM with the Financial Sponsor team, Credit Agricole Italia with the Corporate Finance team, BPER Banca through the Corporate & Investing Banking team, participated in financing the transaction;

Simmons & Simmons with Davide D’Affronto, Alessandro Elisio, and Francesco Burla, and Dentons with Alessandro Fosco Fagotto and Gaia Grossi for supporting the financing banks.

Absolute S.p.A. , in its turn, was assisted by:

– Pirola Corporate Finance S.p.A. for financial aspects and transaction structuring with Mario Morazzoni, Stefano Righetti, Antonio Visioli, and Pasquale Alessandro;

– Pirola Pennuto Zei & Associati for legal, tax aspects, transaction structuring, and contract work with Stefania Meschiari, Federica D’Amelio, Vincenzo Cicoria, and Michele Fava;

– KPMG for vendor financial due diligence with Andrea Longoni, Ivan Stojanov, and Giovanni Lucchese, and for vendor legal and labor due diligence with Domenico Litido, Giulia Cantini, Emanuele Arraffuti, and Antonio Falcone.